Section 4.10: Energy

Hypothesis:

Securing a grid connection and high energy prices are challenging in many parts of the country, but they are a particular challenge in the West Midlands because of the disproportionate number of manufacturing businesses running high temperature processes across dispersed sites. The West Midlands has the ability to mitigate these challenges and reduce its energy consumption by pursuing smart energy systems.

The UK has comparatively high industrial energy cost compared to similar countries. For example, the UK’s electricity costs are 34-39% higher than in Germany, 31%-53% higher than in France and up 400% more than those in the US. Due to the West Midlands’ significant proportion of energy-intensive industries running high-temperature processes across dispersed sites, these high national prices lead to three challenges that constrain the region’s productivity and its transition to net zero.

- Competitiveness. For example, in 2023 businesses spent the equivalent 4% of regional GVA on energy costs – double what was spent in 2022 and effectively representing a 2% drag on the West Midland’s potential GVA. In the short-term, high national electricity prices make the region’s businesses less competitive compared to international rivals.

- Reduced investment demand. High-electricity prices reduce businesses’ profits and so scope for investment in the region. Over the longer-term, as discussed in the previous sub-systems, lower investment is associated with lower productivity and innovation.

- Net zero transition. Dispersed clusters of industrial energy demand make decarbonisation more costly due to the complexity and inefficiencies involved in infrastructure investments. Combined with high-electricity prices today, the uncertainty around the perceived cost to electrify these businesses further disincentivises investment – constraining growth and slowing the net zero transition.

It often takes businesses between 5 and 10 years to establish new energy network connections in Great Britain and there are no new electricity transmission connections planned for the West Midlands until 2036. This presents a significant issue because the net zero transition will require widespread electrification of energy demand currently met by gas and petroleum.

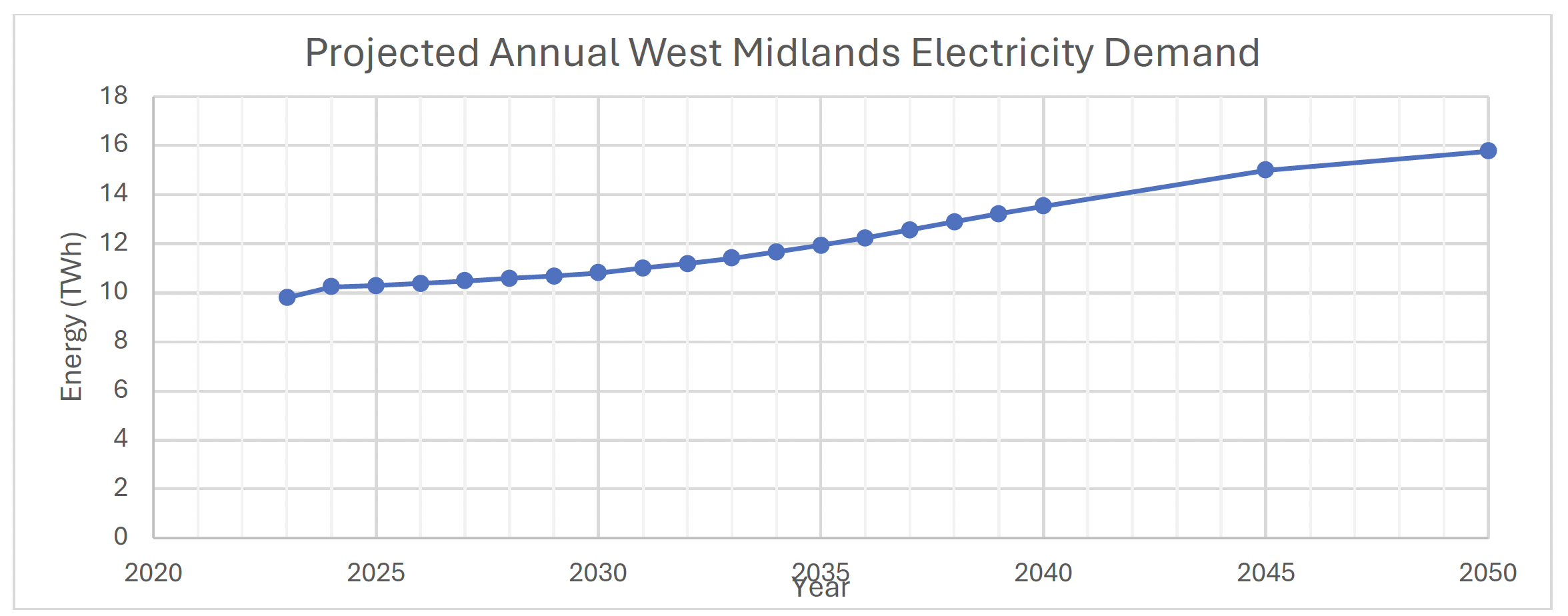

Industrial electricity use is expected to increase by 78% in the region between 2024 and 2050. Overall, increased electricity demand from industry and technologies such as heat pumps and electric vehicles will put additional pressure on the distribution network, leading to a significantly constrained grid by 2030 without further investment.

Figure 34: Projected Annual West Midlands Electricity Demand.

The Government’s Mission for Clean Power by 2030 prioritises increasing clean energy generation. However, this offers limited investment opportunities for the West Midlands, as the region does not have the requisite sites for offshore wind, coastal hydrogen, and solar farms require.

Instead, the West Midlands Regional Energy Strategy emphasises smart demand management and electrification—smart energy systems—as key pathways to regional decarbonisation and reducing costs. Smart, flexible and digital energy system solutions can do this through improving grid efficiency and capacity and shifting demand loads to periods when there is sufficient renewable energy.

The West Midlands has the strengths to be able to leverage these opportunities. The region has the country’s largest green workforce and a strong track record of innovations – such as the Black Country Industrial Cluster’s concept of Zero Carbon Hubs that enable small groups of nearby emitters to begin to decarbonise. The West Midlands is also located at the centre of the UK’s power distribution network, home to the headquarters of National Grid, Cadent and E.ON, as well as Xoserve – the UK’s largest central data service for the gas market – and Enzen, a leading energy consultancy. The use of smart energy systems could contribute to up to 3% national annual productivity growth by the 2030s as electrification enables wider applications.

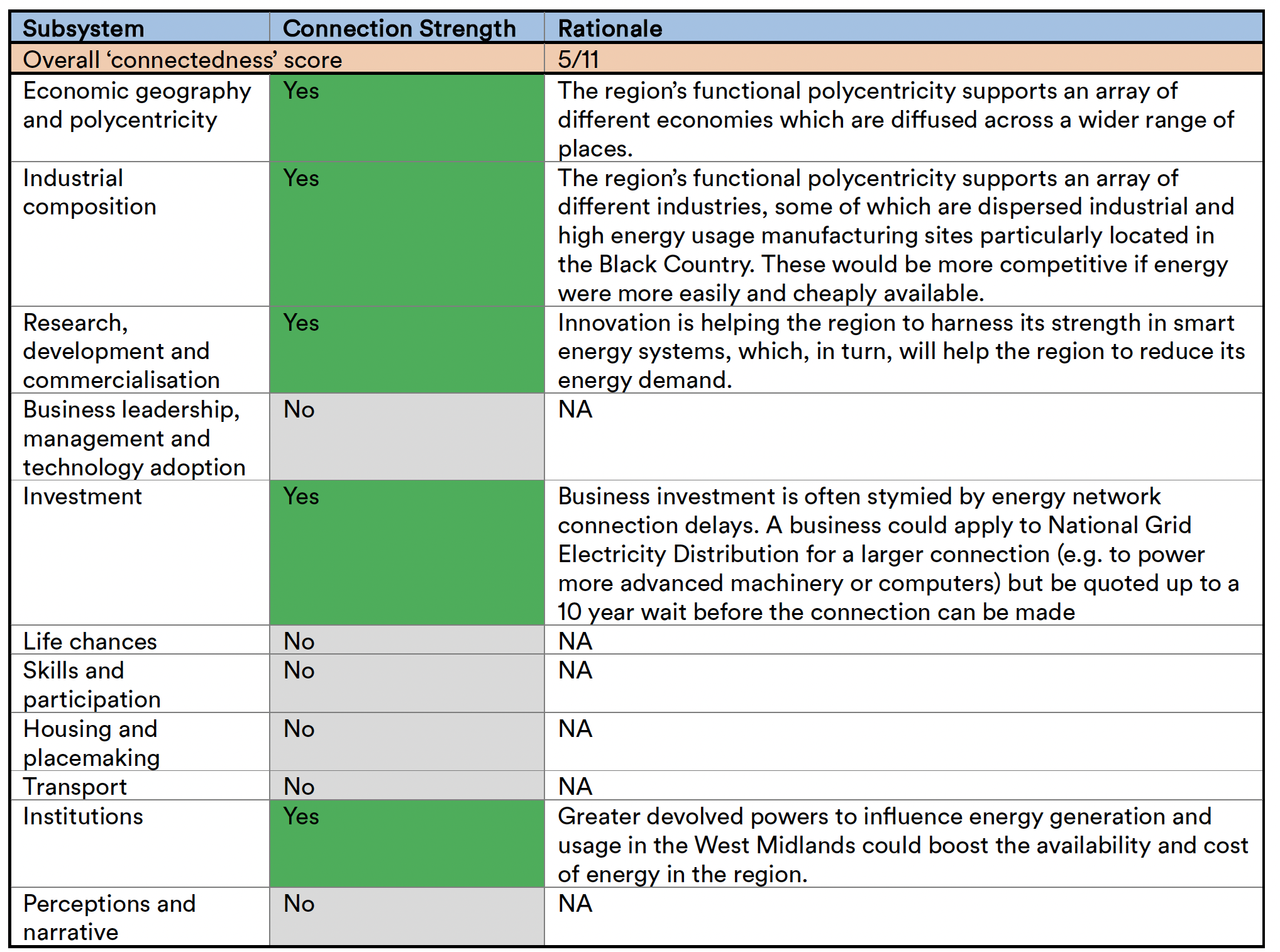

Figure 35: Connection with other sub-systems.