Section 4.3: Research, Development and Commercialisation

Hypothesis:

The amount of private sector research and development is a strength of the West Midlands economy, but it is constrained by the low levels of public and higher education sector R&D.

Research, development (R&D) and commercialisation drive the future productivity and prosperity of economies. Direct benefits come from new businesses with strong competitive advantage and high growth potential while indirect benefits are also important, for example by helping the West Midlands be a place for measured high risk-taking by minimising downsides like reducing the transaction costs of knowledge transfer and amplifying upsides like fostering active networks of investors and helping penetrate international markets.

Our theory of growth considers R&D and commercialisation in two parts: (i) the generation of curiosity-driven research and (ii) the commercial application and commercialisation or translation of research at scale. We also recognise the role of adoption of established technologies widely across the business base, which we cover within the business leadership and management subsystem below. Our two central findings are that:

a. High-quality, curiosity-driven research is generated in the West Midlands, but the depth of this research is constrained by relatively low levels of public and higher education R&D investment.

b. The West Midlands is strong at developing and applying new knowledge for use in established business clusters—e.g. automotive—but weaker in developing for associated commercial uses at scale. If this is to be successful, it must be ruthlessly focused and steered by leaders with commercial acumen who are rooted in the West Midlands.

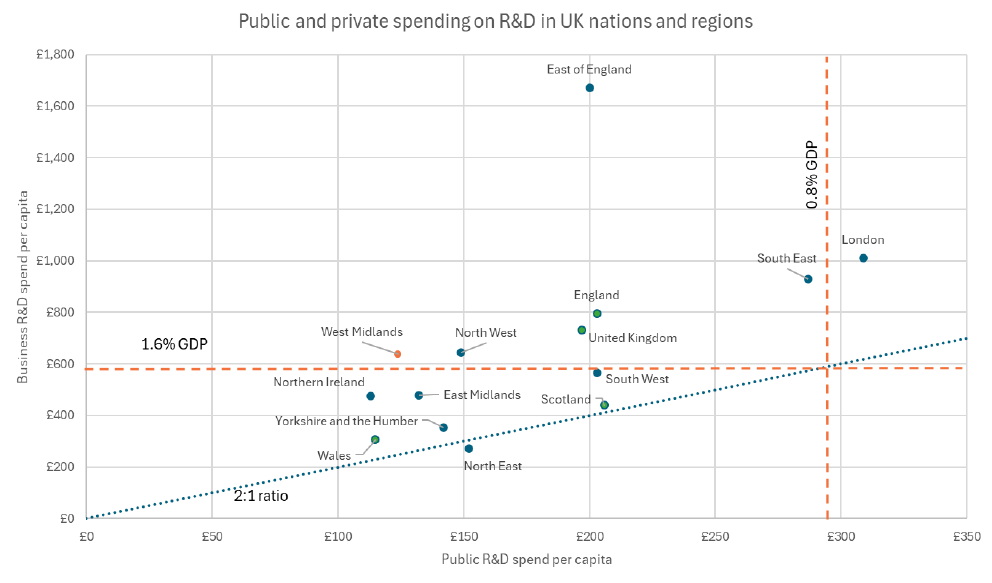

On R&D funding, the West Midlands region exemplifies an extreme case of private sector-led R&D. In 2022, businesses spent £3.8 billion on R&D, compared to roughly £0.7 billion in public R&D funding, giving a 5:1 “private: public ratio” which is the second highest in the UK, far above the average, and one of the most unbalanced in Europe.

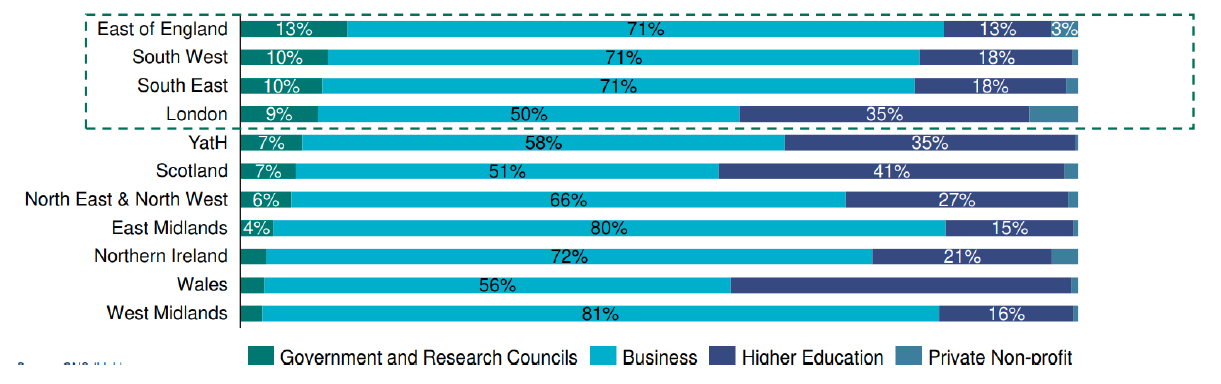

This is consistent with past ONS 2019 analysis which further unpacks the balance between business—at 81% the highest proportion in the UK—and higher education and Government/research council funding.

Figure 14: Public and private spending on R&D in UK nations and regions.

UK Research and Innovation (UKRI) recognises that public investment in R&D outside London, the South East and East of England—collectively known as the ‘Greater South East’—needs to increase. UKRI’s strategic approach to places, set out in their ‘world-class places strategic objective’ within its current strategy, acknowledges the role R&D investment plays strengthening research and innovation clusters across the UK, including in the West Midlands, with the proportion of spend outside the Greater South East rising to 50% in 2023/24. This is up from 49% (financial year 2022/23) and 47% (2021/22). This represents a cumulative additional £1.4 billion invested outside the Greater South East since the 2021 to 2022 financial year.

Figure 15: R&D expenditure in the UK regions by performing sector.

Whilst this is positive for regions such as the West Midlands, the proportion received is still low. Our contention is that the exceptional level of private R&D shows market confidence in the fundamentals of the West Midlands; bright minds are attracted to work in the West Midlands at scale. However, the £3.8 billion business invests in West Midlands R&D each year—with the second highest private: public R&D investment ratio in the UK—has a ‘deep but narrow’ profile; the vast majority focused on a small number of large automotive and advanced engineering businesses. As well as maintaining the region’s competitive advantage in those high-value clusters, it also provides a fertile base of advanced engineering and digital competencies in dual-use technologies.

It is well evidenced that public funding of R&D plays a pivotal role in encouraging private-sector innovation by boosting the confidence of businesses to invest in new, often high-risk but potentially revolutionary research areas. In the West Midlands, the scale of public R&D funding (at £125 per person) is sub-optimal, but there are reasons for optimism.

As the largest public funder of curiosity-driven and translational research, recent UKRI data shows the West Midlands saw the second largest absolute growth (+£171 million) in funding between 2020/21 (£590 million) and 2023/24 (£761 million), meaning per-head spend jumped from to £125 in 2023/24—now the fifth-highest region behind London, South East, East of England, and North East. It hasn’t always been this way; between 1995 and 2015, while West Midlands’ business R&D per head grew on par with Berlin and more than Paris and London put together, public R&D per head in West Midlands stagnated, showing a divergent path which has contributed to a slower long-run growth rate and relatively weaker productivity. The region’s academic research base has a strong starting point, with all six universities in receipt of innovation funding delivering multiple areas of internationally recognised research that has tangible impact beyond academia.

Looking to the future, the level of public R&D funding must be sufficient to boost knowledge across curiosity-driven and translational research, along with capability within the region to sweat that investment for commercial benefit at scale. We suggest there are three reasons why the West Midlands is well-placed to generate bigger rewards for the UK:

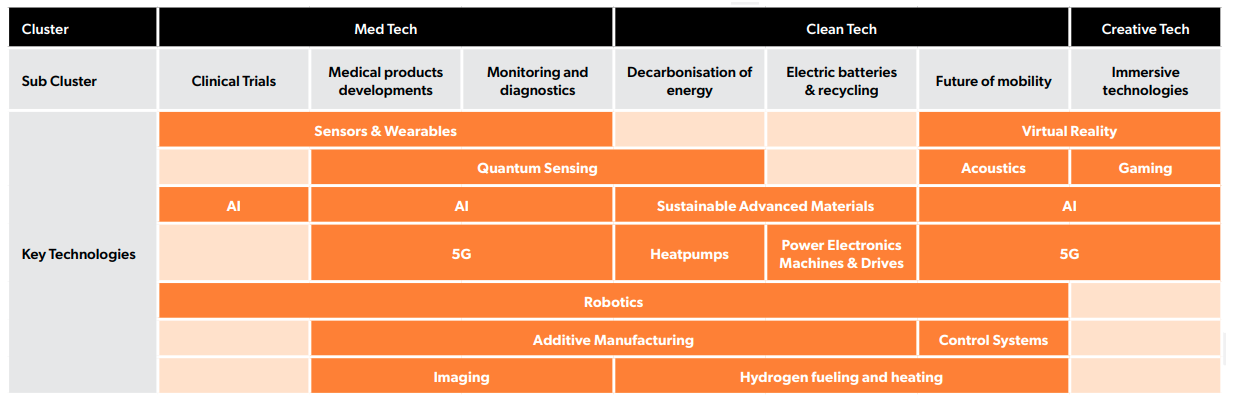

First, our strength in tech development. Led by universities, research institutions and cluster leadership bodies, the region has assessed the technologies that power change and commercial advantage within the region’s priority clusters. The region also has a growing critical mass of innovation capability stimulating the emergence in Medtech, Cleantech and creative industry clusters. We believe these are the cornerstones of strengthening the region’s R&D base, and this is where public R&D needs to focus, applying these dual-use technologies to different contexts and crowding-in private activity.

Figure 16: key technologies in Med Tech, Clean Tech, and Creative Tech clusters.

The West Midlands is one of three regions to pilot a locally-led Innovation Accelerator with Innovate UK to drive translational research. Through the West Midlands Innovation Board’s prioritisation of five projects that relate to its med-tech, clean-tech and cross-sector capabilities priorities, organisations embedded in the region have been delivering specialist, independent translational advice to over 700 firms and helping secure £70 million of additional investment.

Examples from Clean Futures

ChangeMaker 3D (Birmingham) is developing a concrete printing technology for the UK rail sector. It is printing and installing a 3D printed toilet pod, which can integrate rainwater harvesting and solar power.

Global Nano Network (Walsall) have developed a high performance current collector, designed to dramatically improve the cycle life and discharge rate of li-ion and next generation batteries.

Hy-Met (Solihull) has created a rapid and non-contact battery inspection solution to evaluate battery cell quality, that oVers data crucial for new regulatory procedures such as a ‘battery passport’.

Nedra (Birmingham) is developing a lightweight electric vehicle using natural fibre composites, to significantly cut carbon emissions over its lifetime compared to other urban delivery and taxi electric vehicles.

Second, our commercially minded people. Creating value requires different skills and instincts to curiosity-driven research and the application of technology. The West Midlands has people with these aptitudes working through private sector-led activities like Plug and Play UK and Serendip (part of Bruntwood Scitech) to bring people together for rapid, high-risk testing and making commercial judgements as vital steps to commercialising at scale. In the Skills and Employment subsystem, we reflect how the development of commercial skills and risk-management need to be honed across mid and advanced skills levels.

Third, our places. International good practice and examples within the region like the Warwick Manufacturing Group (WMG), Manufacturing Technology Centre (MTC) and Energy Systems Catapult Centres, Birmingham Health Innovation Campus, Enterprise Wharf, STEAMhouse, Springfield Campus and UK Battery Industrialisation Centre show the importance of concentrating people in environments conducive to development and commercialisation be they neighbourhoods or buildings. Major developments like the West Midlands Investment Zone seek to do this at scale, focused on the use of engineering and digital capabilities for commercial growth in advanced manufacturing and associated health tech and energy clusters. Our theory of growth is to intensify this fusion of ideas for commercial benefit, with the wrap-around supply chain and investment system to grow at scale (see the following sub-system on business leadership and investment).

Connecting these three elements requires strategic coordination and championing from civic and business leaders, and significant public R&D investment. The WMCA has built a track record as a testbed for advanced devolution on innovation through the Innovation Accelerator, Launchpad and Action Plan with Innovate UK. With the English Devolution White Paper pointing to new powers for local leaders, together the region has the capability, confidence and ambition to go further with a broader innovation partnership with Government across aspects of research, development and commercialisation; steered by a robust governance system like the West Midlands Innovation Board; and with the ability to connect activity across Government, private investors and local businesses. As proud West Midlanders, the WMCA is best placed to promote this, which we’ve done through the It Starts Here campaign to capitalise on the business potential following the Commonwealth Games and secure the seventh-highest FDI of any region in Europe, and with recognition as one of the top three European Innovation Capital regions in 2024.

Connections with other sub-systems

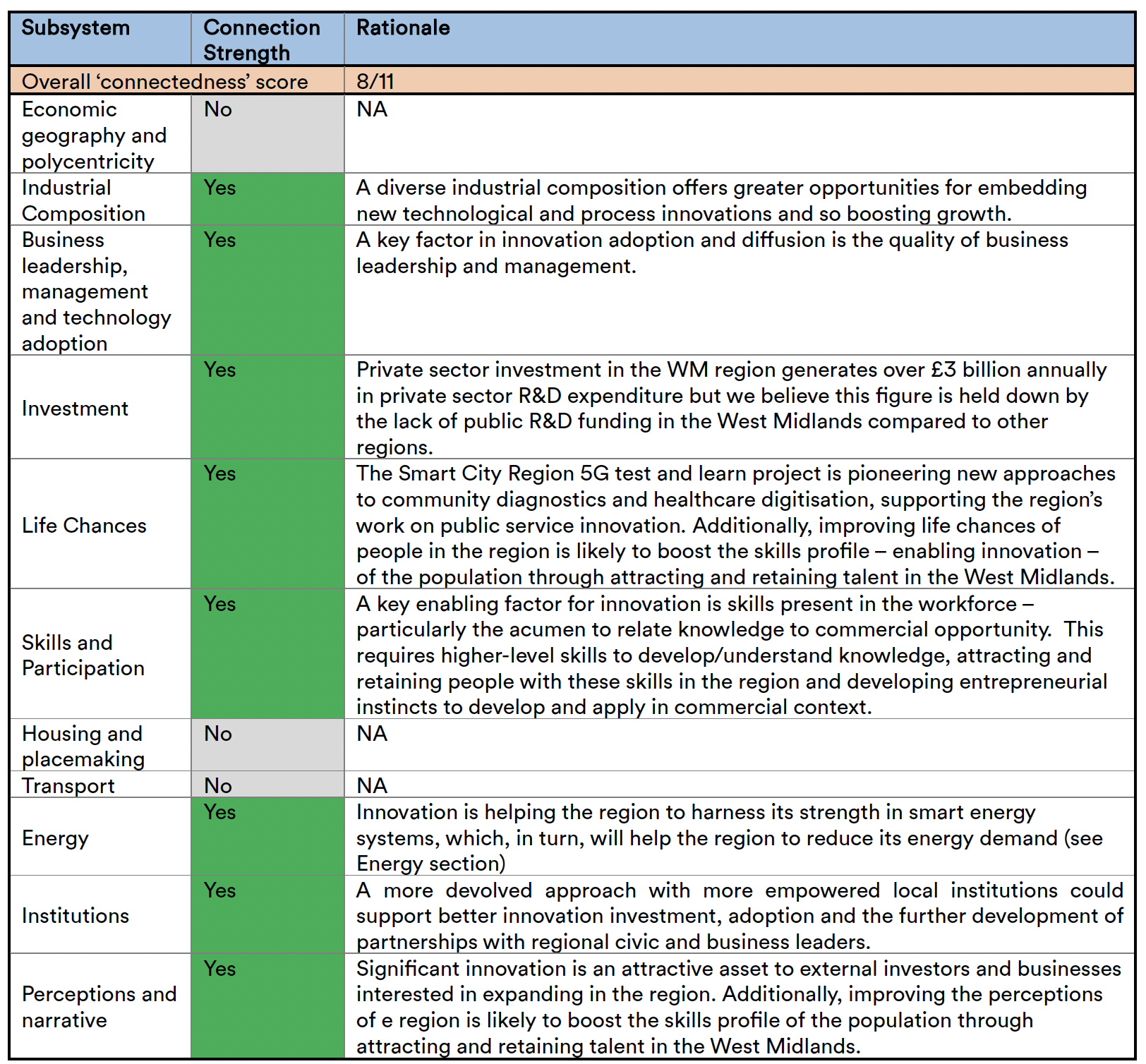

Our R&D and commercialisation hypothesis has implications for several other sections of our theory of growth.

Figure 17: R&D and commercialisation hypothesis implications