Section 4.7: Skills and Participation

Hypothesis:

The West Midlands has a shortage of higher-level (Level 3 and above) skills, which is forecast to increase over the next decade—and is the most significant skills-related constraint to economic growth.

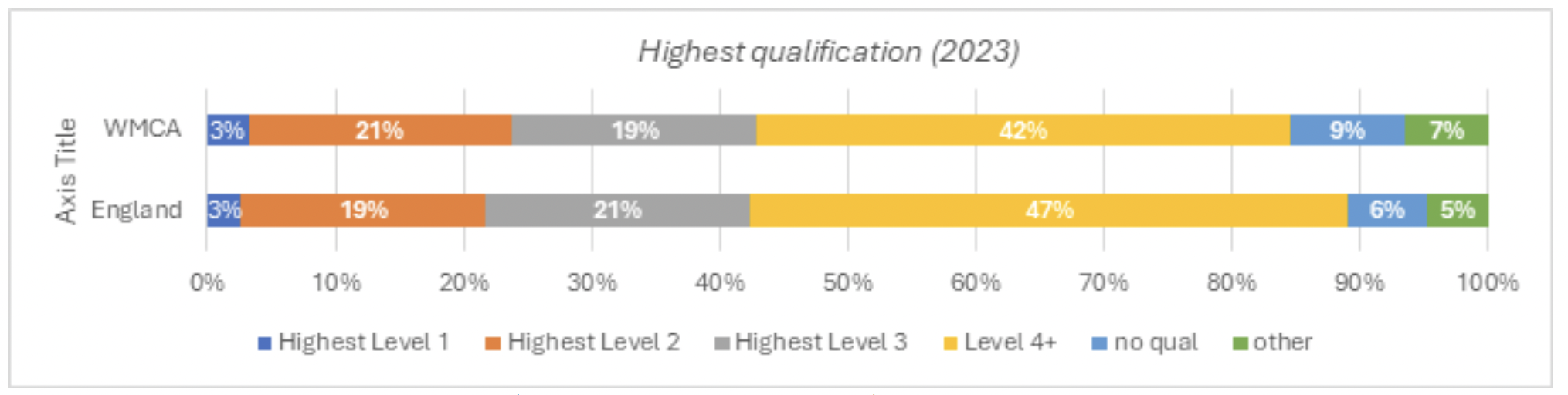

Overall, qualification levels are improving in the WMCA, but they remain lower than the national average and there are significant disparities between local authorities across the WMCA. This restricts growth in the region, with employers reporting persistent skills shortages, with around 1 in 4 vacancies classed as ‘hard to fill’, particularly in roles that require advanced and/or higher skills.

Basic skills and participation remain an issue for many in the region. Around 1 in 10 adults in the WMCA have no formal qualifications. This contributes to the share of the working age population that are economically inactive (26%). The region also has industrial specialisations in low productivity sectors, characterised by a high concentration of low-skilled and often precarious employment. This reduces resident and employer incentives to invest in skills. Addressing this is vital if we are to enable residents to get onto the skills ladder and progress into further learning and better jobs.

Figure 26: Highest qualification achieved (WMCA compared to England), Annual Population Survey.

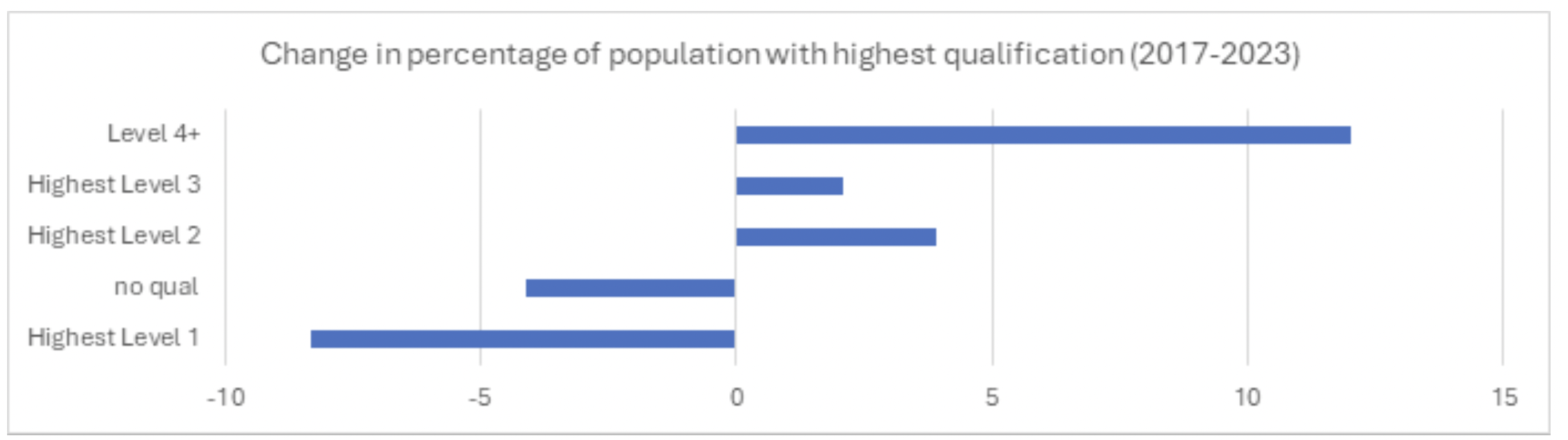

The WMCA is moving towards a higher-skill economy. As illustrated below, over the last ten years the most significant increases in qualification levels among residents have been at the graduate level (Level 4) and Level 2. However, the region has not been as successful in progressing residents into Level 3 qualifications, in part due to lack of access to technical provision, 62% are qualified at Level 3 or above, compared with 68% nationally. We think this lack of progression to Level 3 is a key constraint on the region’s productivity and growth.

Figure 27: Change in percentage of population with highest qualification (2017-2023), Annual Population Survey.

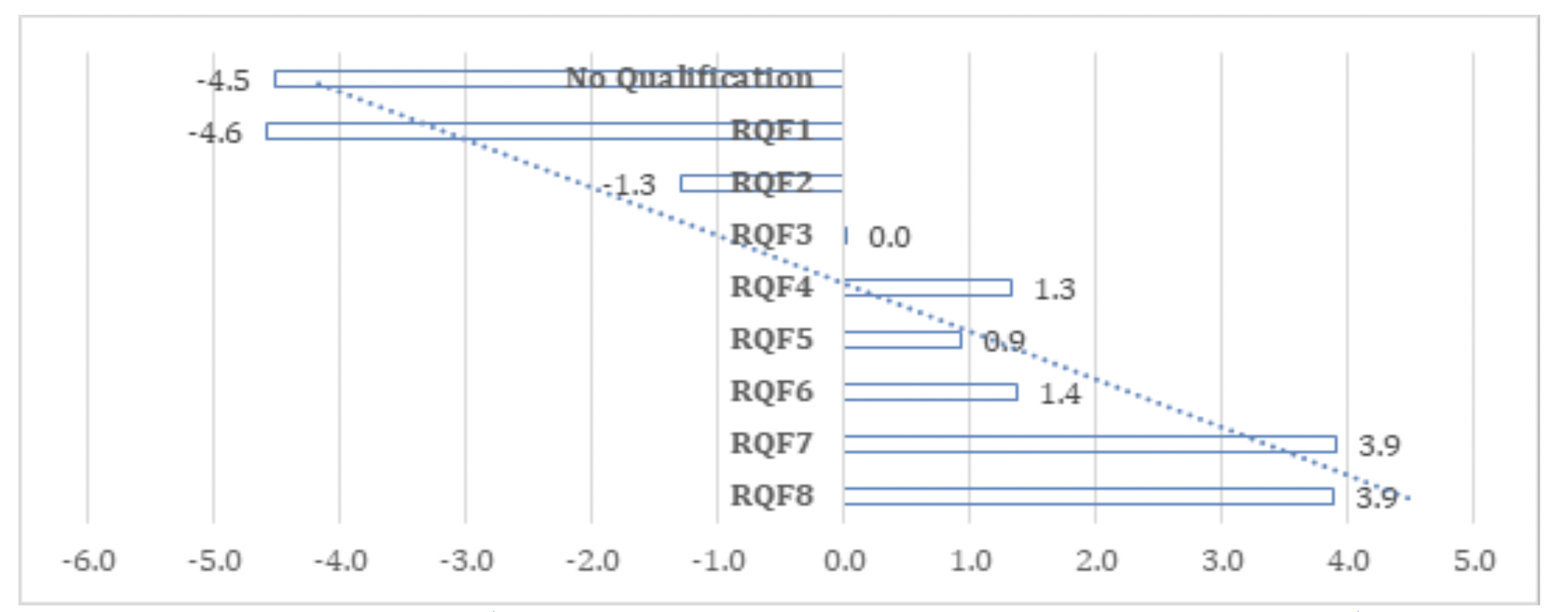

The move towards a higher-skill economy is projected to continue over time. The National Foundation for Educational Research project that by 2035, more than half (55%) of all roles in the WMCA area will require skills and qualifications at Level 4 and above. In addition to replacement demand, forecasts for the WMCA area predicts between 2025-2035 per annum growth in employment by qualification will rise by 1.4% at level 4 and by 0.9% at level 5 (illustrated in the chart below). Developing skills at these levels will also provide opportunities for residents to progress further into employment that requires skills and qualifications at Level 6 and above.

Figure 28: Projected Skills Needs (Labour market and skills projections: 2020 to 2035, DfE, 2020)

Supporting our residents to attain higher-level (Level 3 and above) skills is particularly important because:

- On average, residents in the West Midlands with Level 3 qualifications achieve 16% more in earnings are 4% more likely to be employed than those with Level 2. Analysis of job postings in the WMCA area over the past 12 months shows that, on average, vacancies requiring a level 3 qualification have an advertised annual salary nearly £4,000 higher than those requiring a level 2 qualification.

- As qualification attainment levels increase (L4+) so too does the positive return in earnings for those gaining the qualifications. For example, Level 5 return for men is 21% and for women 29%. The Department for Education’s analysis shows investment in Level 3 is higher value for money than Level 2.

• People with higher level qualifications and who develop higher level skills throughout their

working lives are more resilient to labour market change.

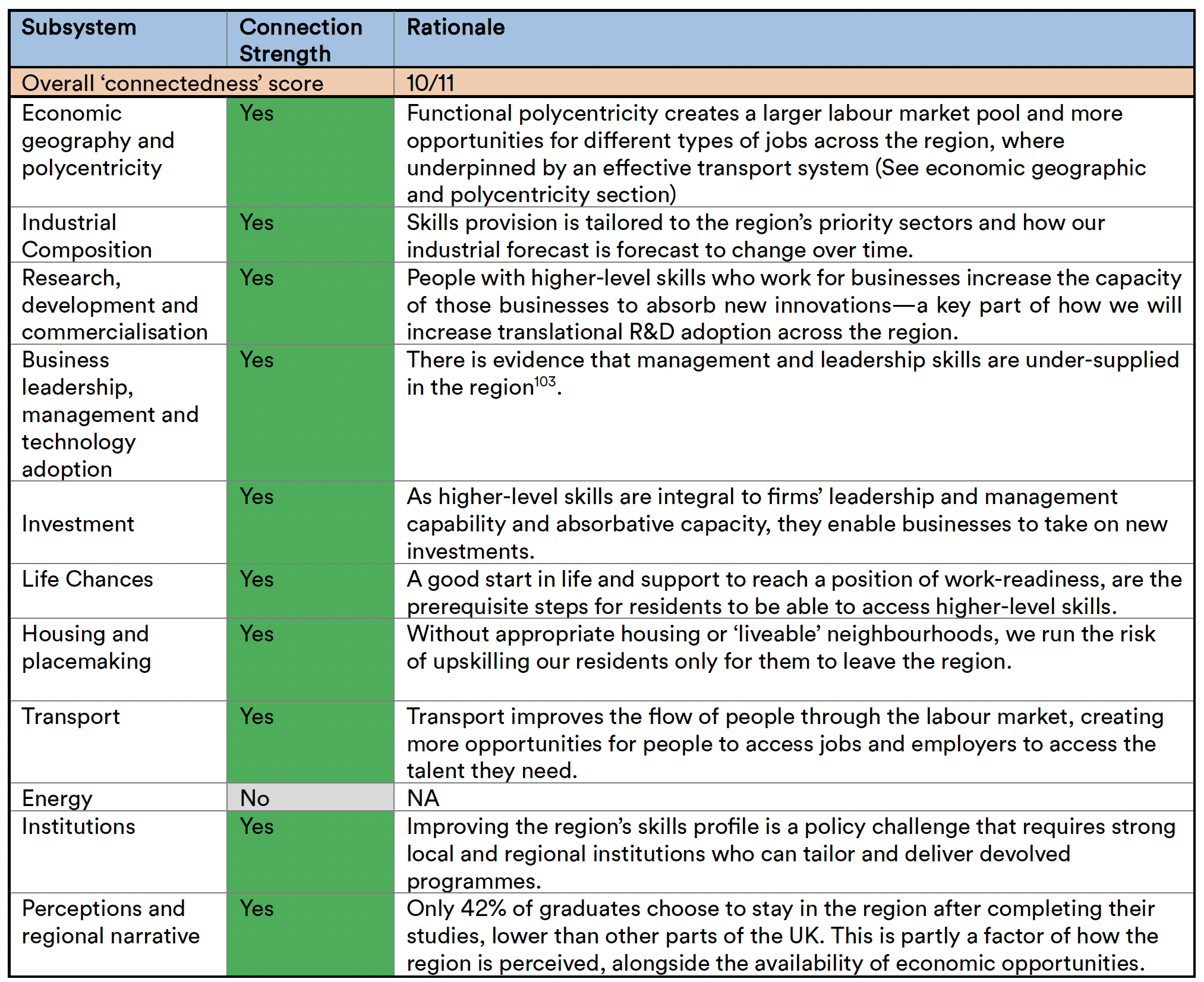

Working with employers to understand the nature of demand for skills and to encourage them to invest and utilise skills is going to be key to achieving the scale of upskilling we need. Against the backdrop of projected changes to the skills profile of the labour market, the large majority of the West Midlands’ future workforce—some 80%—is already in work. Therefore, upskilling our residents with higher qualifications means engaging with the workforce, not just those in formal education. This is in employers’ interests as much as our residents and strongly links to the business leadership and management sub-system outlined in a previous section.

While upskilling our residents via the formal education system and for those already in work is a priority, on its own it will not translate into economic gains for the West Midlands. Providing a supply of the right skills is vital. We think that Level 3 and above skills in science, technology, engineering and maths are particularly important for the generation of new ideas and the ability of firms to convert new ideas into higher output and productivity. These skills also provide a platform from which individuals can train, retrain and develop specialisms.

STEM skills also provide a set of core skills which can be applied across various fields and industries, particularly in sectors and clusters which require green technologies and processes. Increasingly, green skills are understood to be crucial for resilience of firms across a wide range of sectors, in addition to traditional energy intensive industries. Developing the green skills of our current and future workforce is important for both our achieving net zero ambitions as well as maximising growth and employment opportunities, given the region has the country’s largest green workforce.

More West Midlanders have graduate degrees than are currently working in the region101 and those who do attain a higher education qualification in the West Midlands are less likely to stay in the region upon graduation than elsewhere in the UK102. This is known as the ‘brain drain’. We think the answer to this is to work with businesses to create economic opportunities for those qualified to graduate-level of above to work in the region, which is one of the functions of earlier subsystems focused on business leadership and management, innovation and investment; and later subsystems focused on housing and perceptions of the region.

Connection with other sub-systems

Figure 29: Connection with other sub-systems.